nebraska auto sales tax

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Additional fees collected and their distribution for every motor vehicle registration issued are.

Car Sales Tax In Nebraska Getjerry Com

The point of delivery determines the location of the sale.

. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. The Nebraska state sales and use tax rate is 55 055.

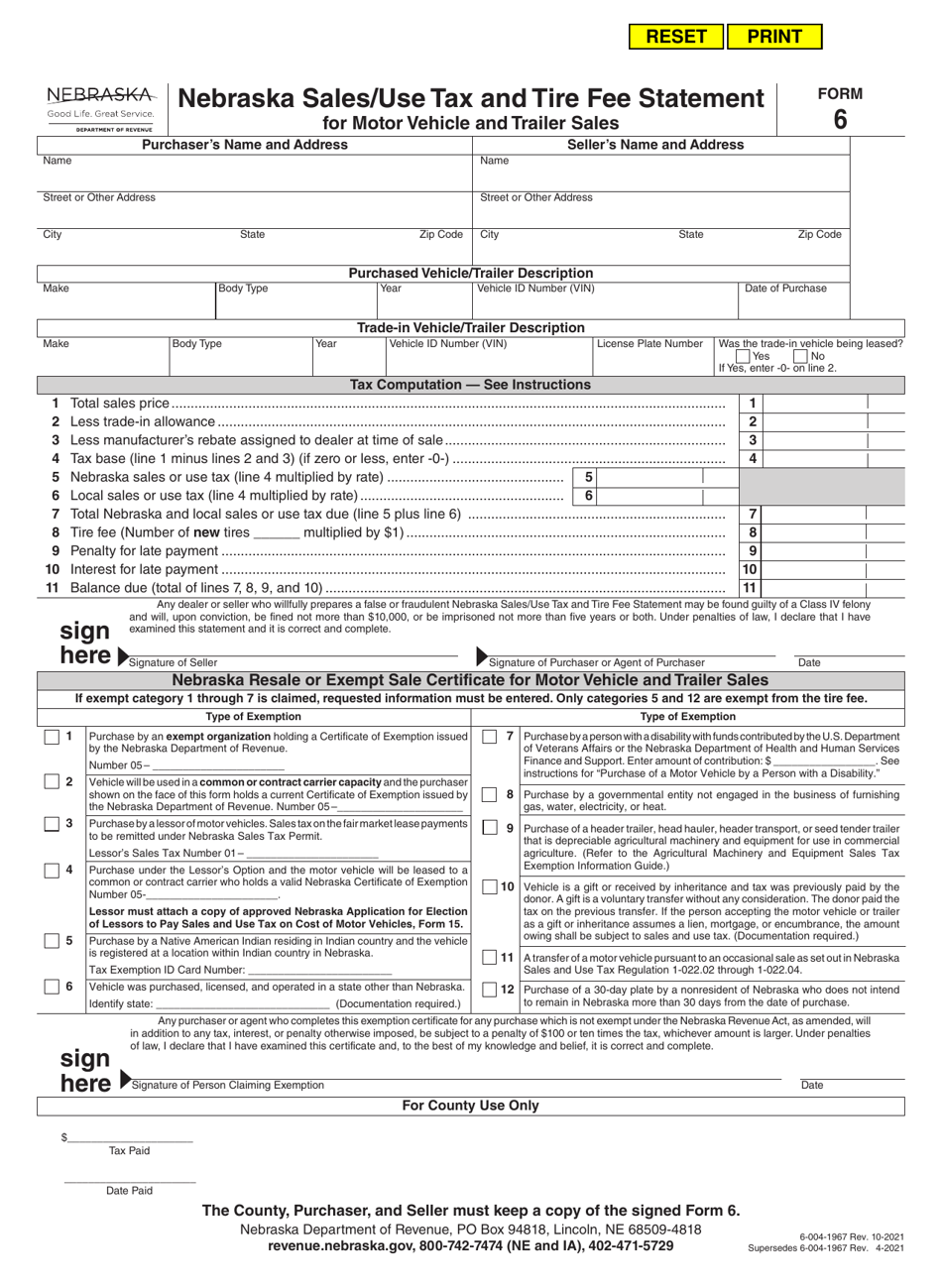

Register the vehicle and pay sales tax. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser. Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent.

L Local Sales Tax Rate. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for Direct. Here are five additional taxes and fees that go along with a vehicle purchase.

Current Local Sales and Use Tax Rates Vehicles Towed from Private PropertyVehicles Left Unattended on Private Property Transfer of Ownership. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918.

Purchase of a 30-day plate by a nonresident of Nebraska who does not intend. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Deliveries into another state are not subject to Nebraska sales tax.

The state of NE like most other states has a sales tax on car purchases. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. Vehicles are considered by the IRS as a good that can be purchased sold and traded.

If you are registering a motorboat contact the Nebraska Game and Parks Commission. Nebraska vehicle title and registration resources. Qualified businessprofessional use to view vehicle.

Like all other goods retailers are required to charge a sales tax on the sales of all vehicles. If you are registering a motorboat contact the Nebraska Game and Parks Commission. The process is much easierand quickerif the vehicle.

The Nebraska sales tax on cars is 5. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special.

This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. Nebraska has recent rate changes Thu Jul 01 2021. Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E.

150 - State Recreation Road Fund - this fee. In addition to our brief summary you should study Vehicle Importation Regulations and then contact an expert to help you at the National Highway Traffic Safety Administration NHTSA at 888 327-4236. The Nebraska sales tax on cars is 5.

Select the Nebraska city from the list of popular cities below to. The Nebraska state sales and use tax rate is 55 055. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Nebraska has a 55 statewide sales tax rate but also has 295. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. Nebraska auto sales tax Monday May 9 2022 Edit.

The sales tax rate is calculated at the rate in effect at that location. 31 rows The state sales tax rate in Nebraska is 5500. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska.

There are no changes to local sales and use tax rates that are effective July 1 2022. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. Via email from the Sarpy County Treasurers Office.

Money from this sales tax goes towards a whole host of state-funded projects and programs. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Vehicle Title Registration.

This is less than 1 of the value of the motor vehicle. Failure to do so is a Class IV felony. Prepaid maintenance is taxable in Nebraska and can be included on the warranty line of the calculator for accurate handling.

You can find more tax rates and. To remain in Nebraska more than 30 days from the date of purchase. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax.

How Does Sales Tax Apply to Vehicle Sales. You can find these fees further down on the page. There are no changes to local sales and use tax rates that are effective January 1 2022.

Sales and Use Tax Regulation 1-02202 through 1-02204. Nebraska Sales Tax on Cars. There are no changes to local sales and use tax rates that are effective January 1 2022.

Bringing a car into America from another country can be a tricky process. Deliveries into a Nebraska city that imposes a local sales tax are taxed at the state rate 55 plus the applicable local rate. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. 1st Street Papillion NE 68046. With local taxes the total sales tax rate is between 5500 and 8000.

Nebraska SalesUse Tax and Tire Fee Statement. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services.

Nebraska Sales Tax Small Business Guide Truic

Sales Tax On Cars And Vehicles In Nebraska

![]()

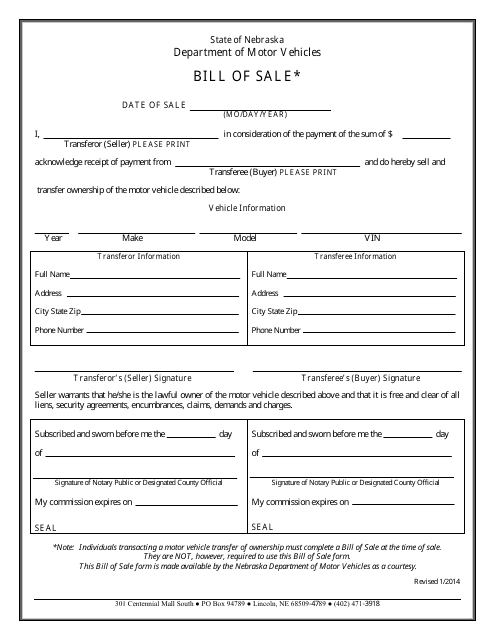

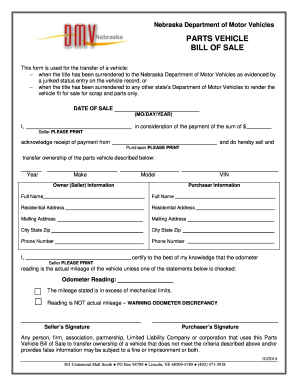

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

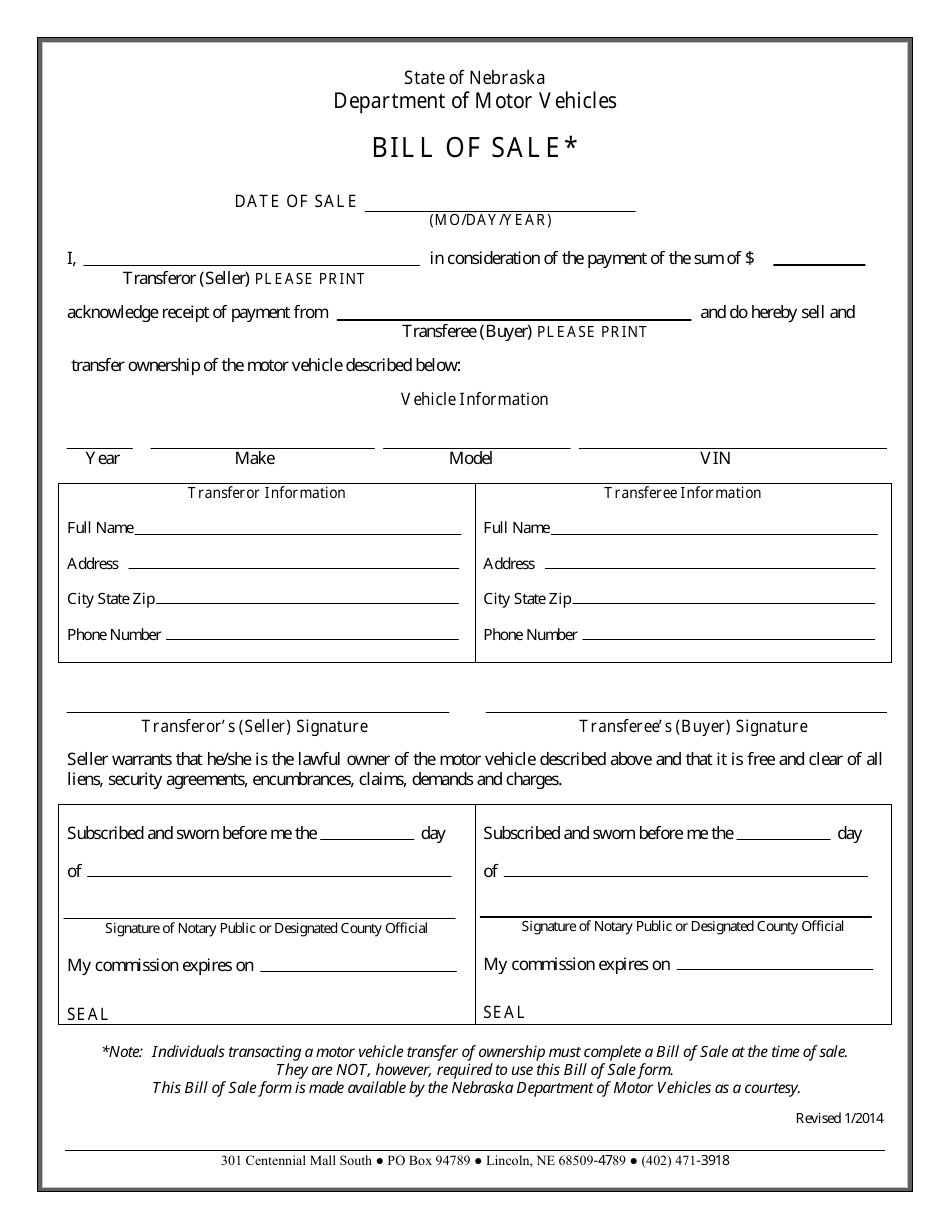

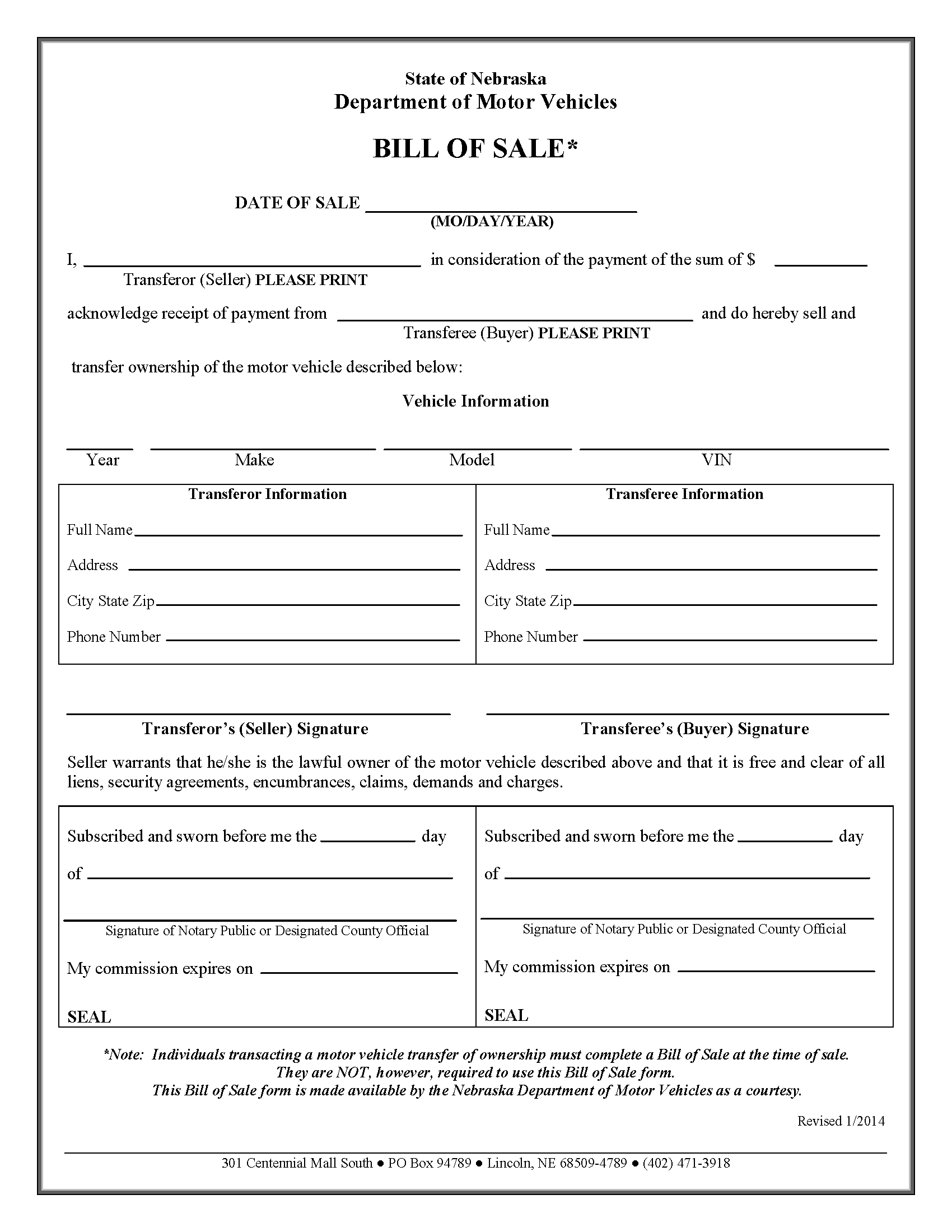

Nebraska Bill Of Sale For Vehicle Download Fillable Pdf Templateroller

Bill Of Sale Nebraska Fill Out And Sign Printable Pdf Template Signnow

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Nebraska Bill Of Sale For Vehicle Download Fillable Pdf Templateroller

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

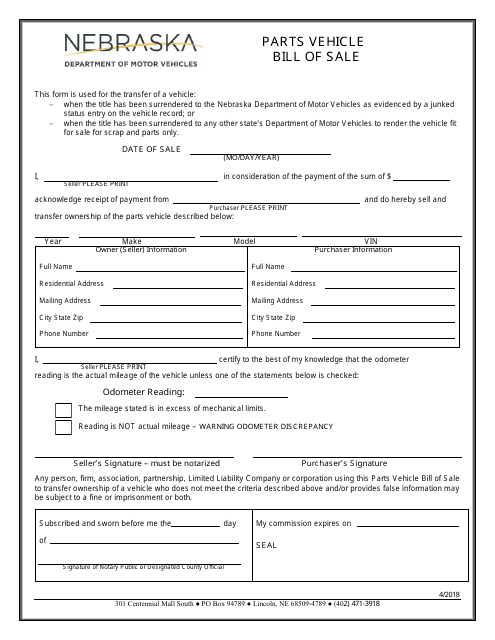

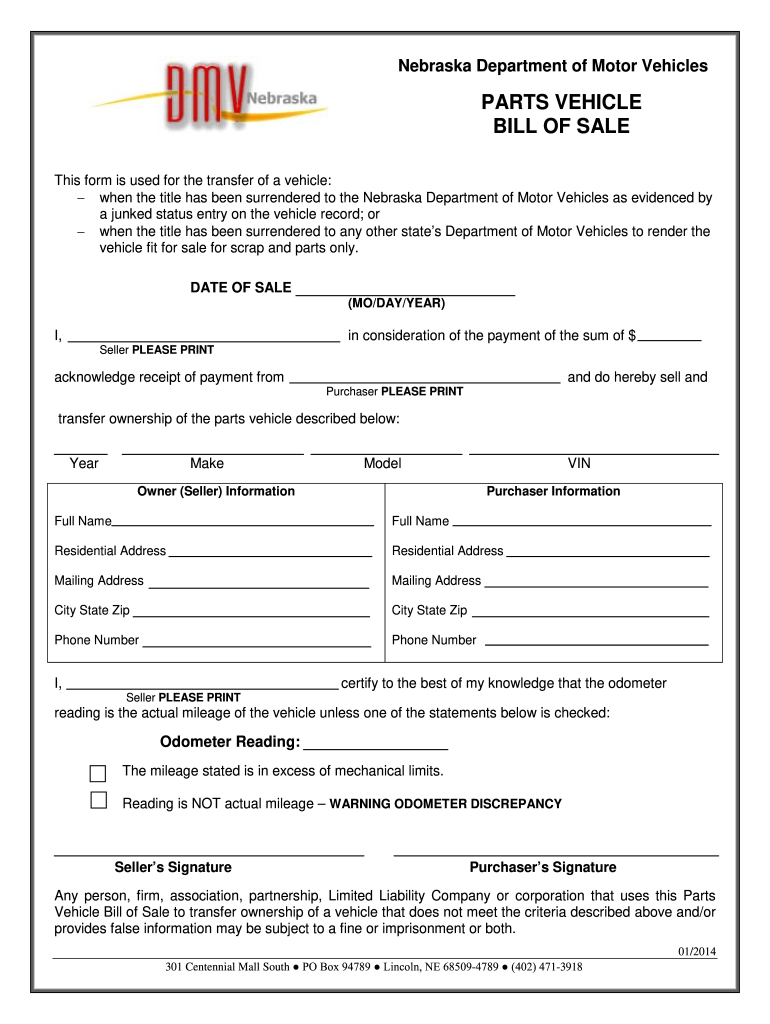

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Nebraska Parts Vehicle Bill Of Sale Download Fillable Pdf Templateroller

All About Bills Of Sale In Nebraska The Forms And Facts You Need

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Vehicle And Boat Registration Renewal Nebraska Dmv

Car Sales Tax In Nebraska Getjerry Com

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

Car Sales Tax In Nebraska Getjerry Com

Bill Of Sale Nebraska Fill Online Printable Fillable Blank Pdffiller